The Cashbox

- a starting point for financial management

The beginning of many financial environments; an office, a local Assembly or even home usually starts with the idea of the cashbox: a secure container for holding valuables. It’s a tangible concept that helps anyone who wishes to get started with managing money.

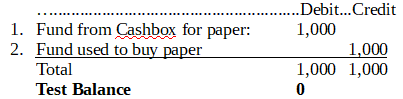

Second in importance to the cashbox concept is that of “Double-Entry Accounting”. It is founded on the idea that for every financial transaction, there is a source and destination – of which must balance to zero; in other words the sum of the inputs must equal that of the outputs.

An Example:

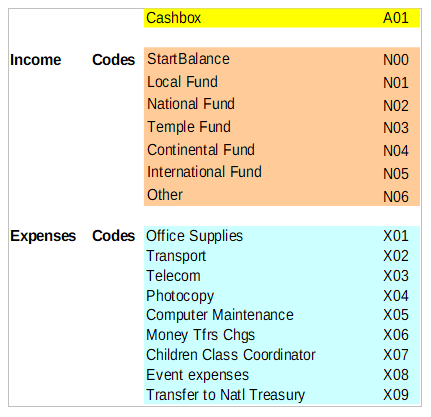

The third concept in importance is that of a Code of Accounts – a collection of codes that create “containers” to which, in the simplest scenerio, place those inputs and outputs as income and expenses.

Thus one establish a simple ledger where two columns, Debits and Credits define the action with respective to each Income and Expense code. However with the Cashbox “container”, one doesn’t think of Debits but as “Deposits” and Credits as “Collections-from”.

Sample Cashbox COA

Our purpose here is to state a starting point. The Internet, the libraries world-over are full of tutorials that assists one to understand these basic concepts. This author found the help files associated with open-source software: GNU Cash, quite helpful.

Before getting involved with an accounting software package, it would be very helpful to start with a spreadsheet such as Excel or LibreOffice Calc as to get an understanding how Double-Entry Accounting works.

For purpose of demonstrating the above, here below are links to a spreadsheet example labelled: “Running Balance 7Column Accounting System01” with versions both in Excel and LibreOffice.

LibreOffice-Version (.ods 23kb)Excel-Version (.xlsx 9kb)