SQL-ledger: Staff as Vendors

revised: 19-Sep-2023

Staff as Vendors for Payroll Management

Creating vendors eases payroll tasks in SQL-ledger for the following reasons:

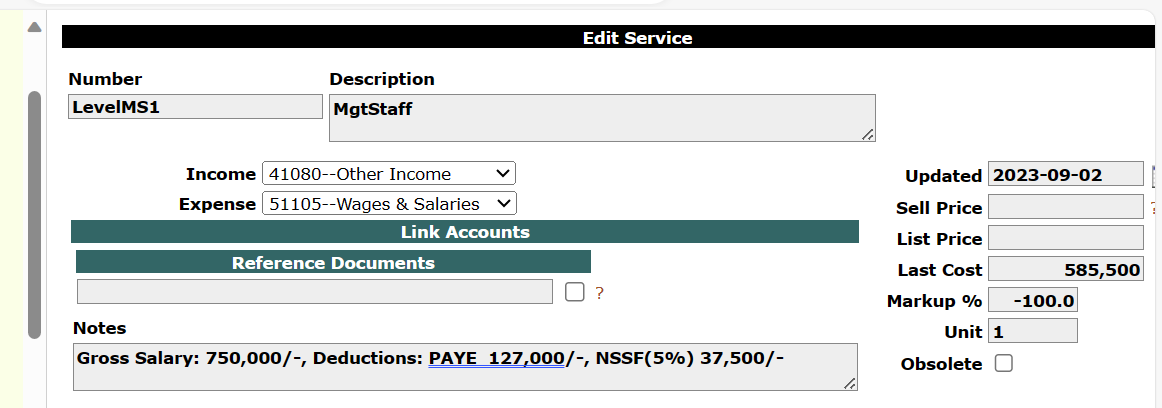

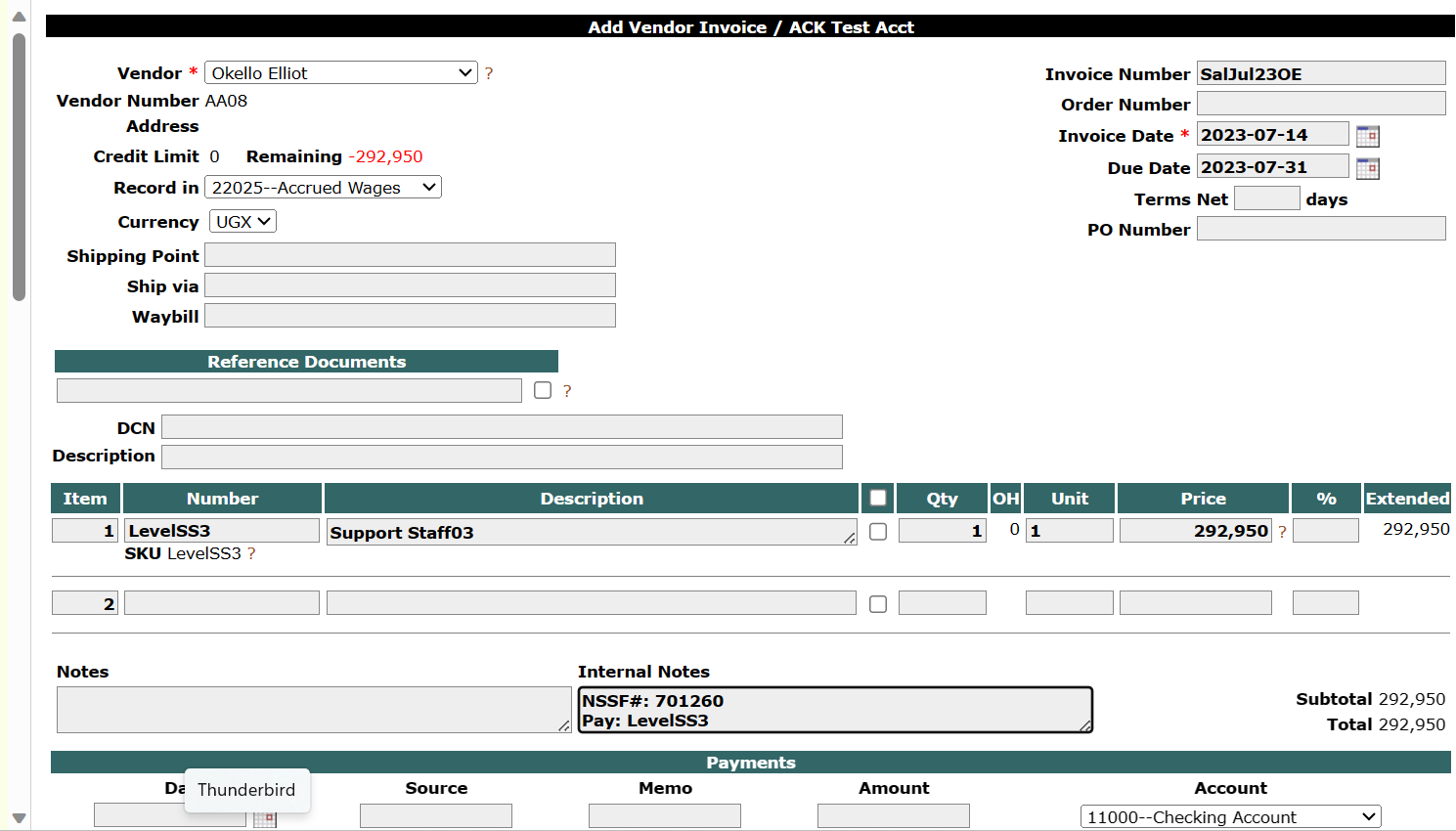

- Staff levels set as services Each month, a vendor invoice is raised for each staff member with a service charge set according to net salary.

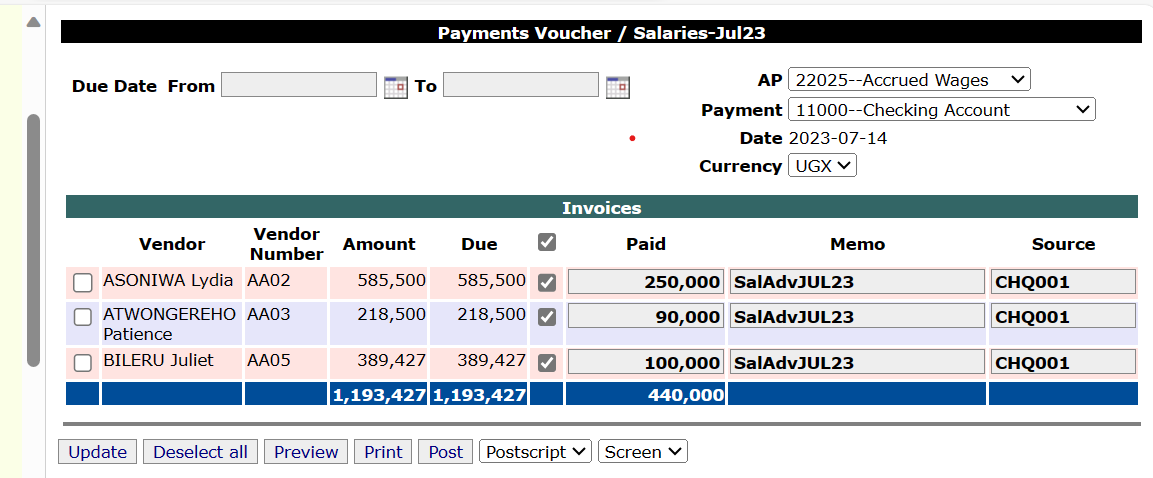

Payroll payments (partial or full) then can be bulk paid via Vouchers->Payments or individually (Payment). Don't forget to process payments via Vouchers->Reports->All Batches.

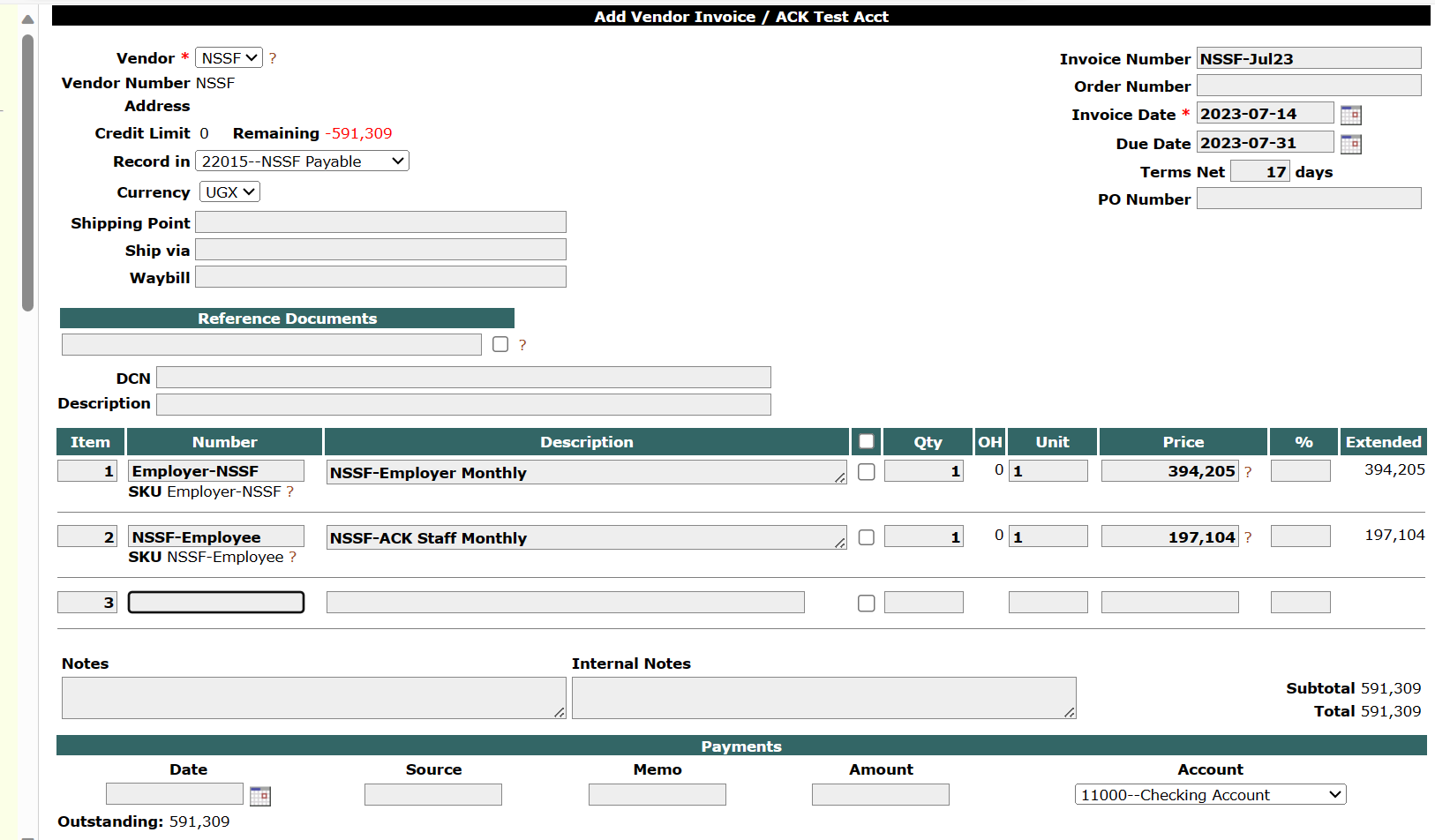

- Staff taxes and social security These monthly payments can be handled simply by the General Ledger. Alternatively, the tax authority could be setup as a Vendor with 'services' created that correspond to the tax level (charged to 'Wages') of each salary level multiplied by the number of staff within each level. NSSF, similiarly would have two 'services': NSSF-employee (charged to Wages) and NSSF-employer (charged to another expense account, such 'NSSF Employer').

Additional Tips

- Staff Loans: Create an AP account (eg. Staff Loans) and a service (eg. LoanStaff) - service with zero value. Then raise a Debt invoice for that staff member, setting the loan amount under the service 'LoanStaff'. That debit invoice will come up, when for that staff, one uses Voucher->Payment (no 's') thereby making deductions on the salary payment. One can use the same payroll cheque number, used for the monthly payment (advance or final).

- Allowances and Overtime: These too can be setup as services. Overtime could be an hourly cost charge conveniently multiplied in the vendor invoice.

- Examining the 'Chart of Accounts' after each step will confirm the effect on the ledger.

- Saving the ledger at important changes or transaction enables one to create a 'restore point'.