SQL-ledger: Simple Payroll

revised: 19-Sep-2023

Generl Ledger Approach to Payroll

The example below follows a payroll scenerio very common to East Africa, whereby employees pay an income tax called 'PAYE' (on graded level), and social security 'NSSF' (5% of gross salary and which the employer paids 10%).

To get familiar with the payroll, it is recommended to use a fresh test database and follow the example steps below:

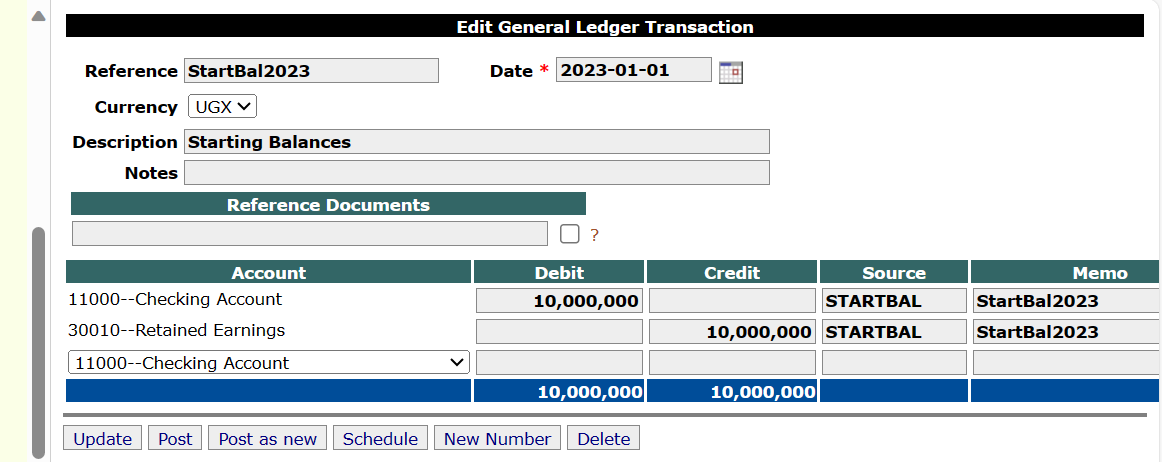

- a. StartBalance of Current Account

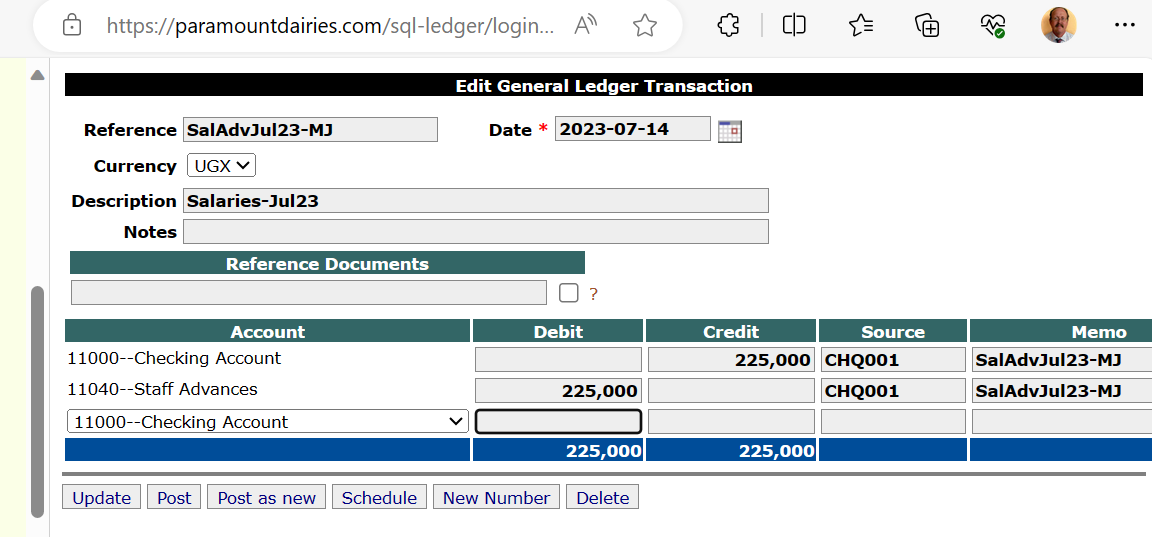

- b. Mid-Month Salary Advance of one staff member 'MJ'

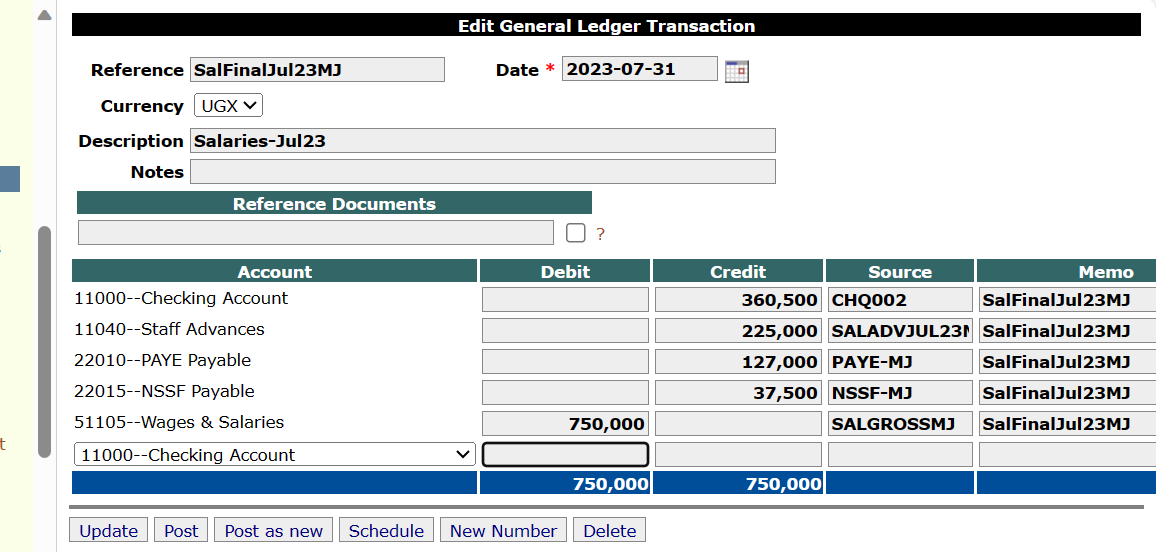

- c. Final Salary Cheque of this staff member (Gross salary: 750,000/-)

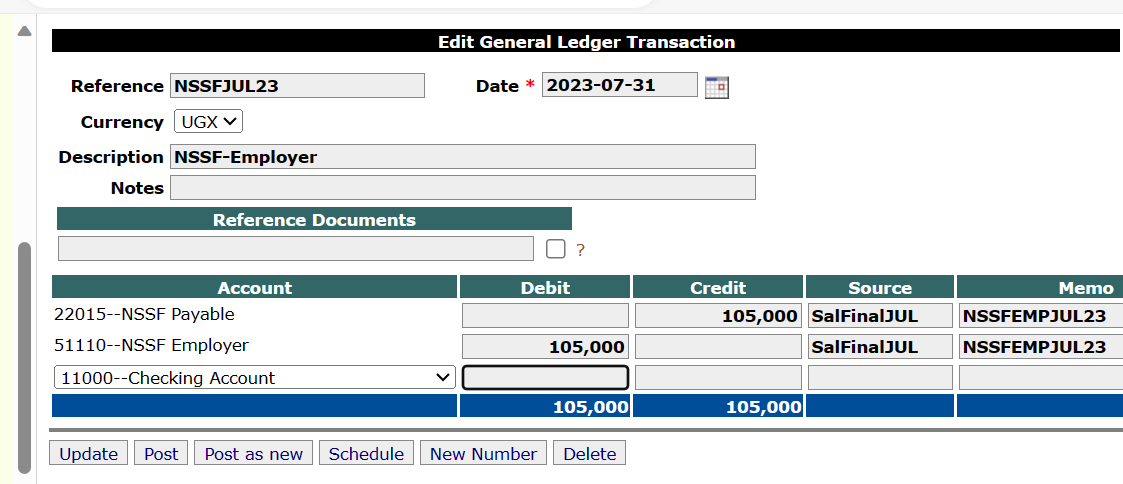

- d. Employer NSSF Liability transaction

The above would involve two cheques (SalAdv and SalFinal). The same cheque number could be used to cover several employees. It is left to the reader to see that to fully finalize the monthly payroll, cheque payments to the Revenue Authority and NSSF office are require to clear these liability accounts.

Additional Tips

- In checking the 'Chart of Accounts' via Reports ->Chart of Accounts, the effects of the transaction can be easily followed.

- With any initial payroll transaction, it can be copy for the next month with 'Post as new'.

- Keep a consistent nametag structure (without spaces in between) eg. SalAdv23mmm where 'mmm. is the 3 letter month. This has the advantage of the excellent search engine within: for example in 'General Ledger'->'Reports' one can put into the 'Memo' box, SALADV% by which '%' is a wildcard and results should show all Salary advances if one has held to a regular naming pattern.