Payroll via SQL-Ledger HR

revised: 09-Sep-2023

SQL-ledger v3.2.12 has useful human resource module in the ‘HR’ menu item [add employees], with their personal info and to give each employee a alphanumeric code (eg. EMP001) in the “Employee Number”.

Suggested Payroll Preparations

- 1. Chart of Accounts: to establish all the necessary accounts –adapted via [System]-> [Chart of Accounts] -> [List Accounts] and click on the account number to add/remove attributes;

- a) Expense Account – Wages + Salaries (eg. 5410) with Attributes: AP lineitem 'On' & Non-tracking Expense

- b) Expense Account – Social Security - NSSF employer (eg. 5420)

- e) Liability Account - Accrued Wages (eg.2190) as summary account to record: activate 'AP'

- c) Liability Account – Social Security -NSSF (eg. 2260) with Attributes: AP lineitem 'On'

- d) Liability Account – Staff Income Tax - PAYE (eg. 2280) with Attributes: AP lineitem 'On'

- f) Asset Account - Chequing (eg. 1060) with Attributes: AP + AR 'payment'

- g) Asset Account – Cashbox (eg. 1065) with Attributes: AP + AR 'payment'

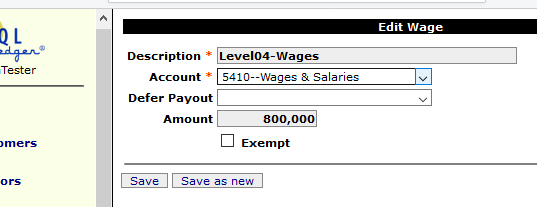

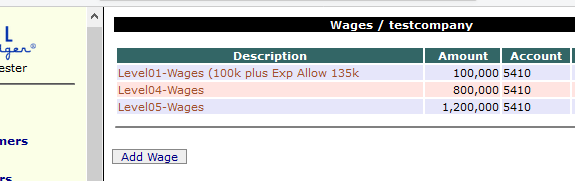

- 2. Establish Wage levels (eg. Wage01)

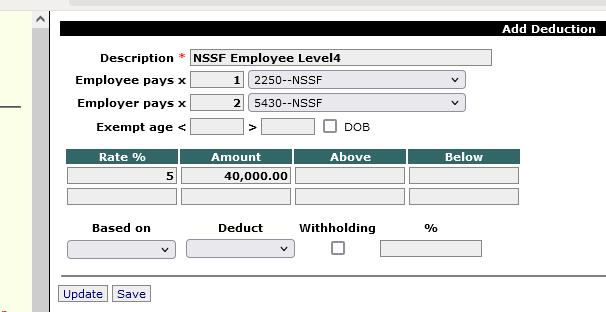

- 3. Establish Corresponding Staff Income Tax and Social Security levels (eg. PAYE01 and NSSF01)

- 4. Establish Employee Accounts linked to their Wage Level (eg. EMP01)

- 1. Establish all the monthly wage levels

creating a comprehensive list

- 2. Accordingly to each wage level, establish the monthly deductions

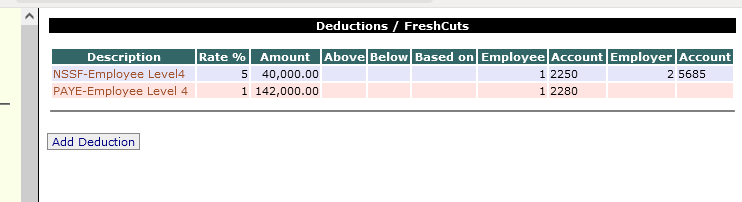

2.a Example of Social Security/NSSF deduction

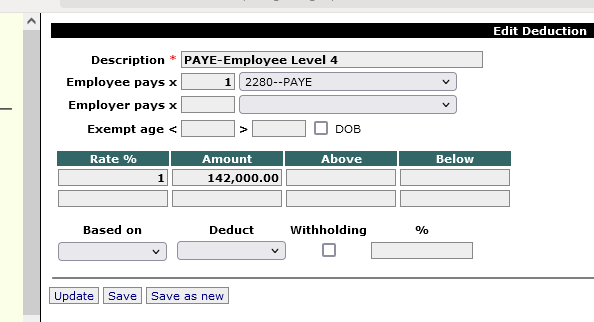

2.b Example of Employee Income Tax/PAYE deduction

2.c Summary Table of deductions

- 3. Establish Employee Accounts according to their wage level, and monthly deductions

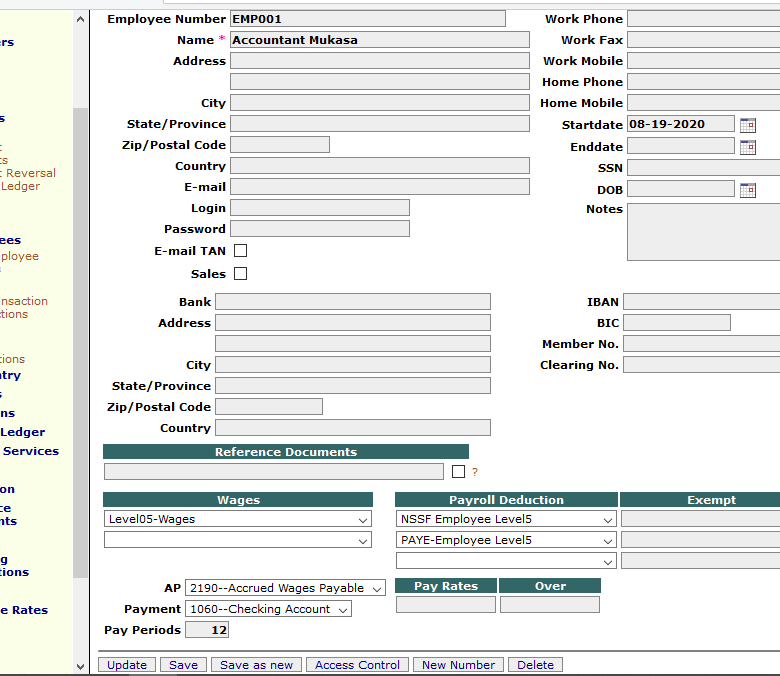

3.a Example of an Employee Account

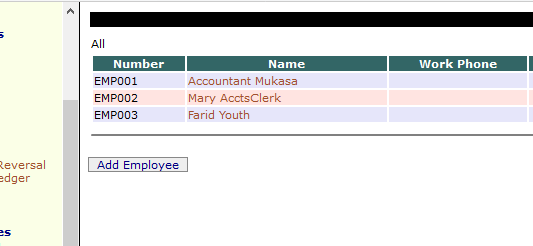

3.b Example of Employee List

Setup Procedure

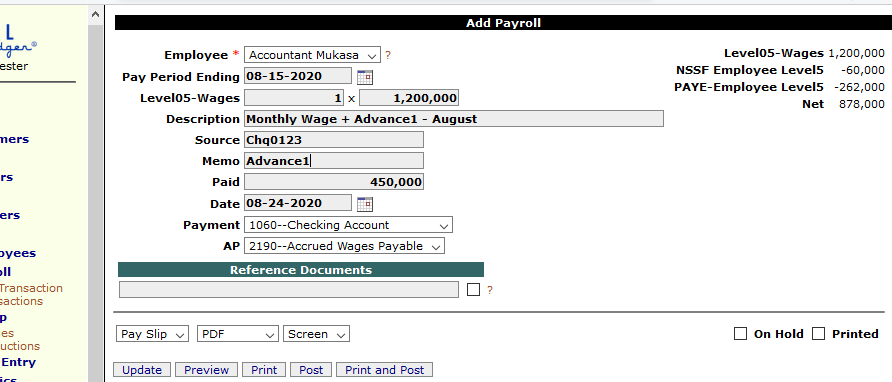

Via HR -> Setup one would:Around mid-month, one would post the monthly wage together possibly with a mid-month advance for each employee. Essentially, this posting acts as a "Vendor Invoice". Under HR, one would 'add transaction' and the entry could look like this:

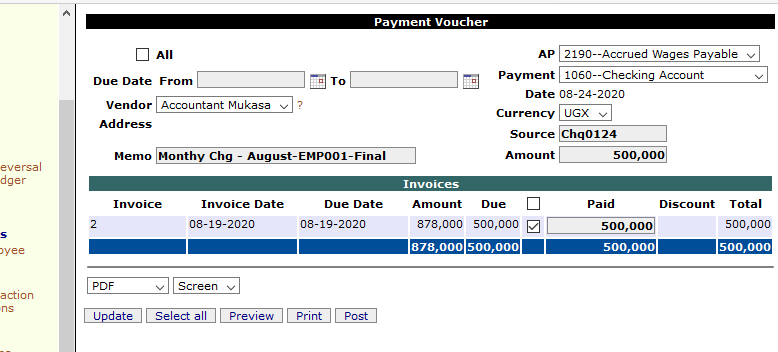

For the final monthly payment, one would go to AP/Vouchers -> Payment [or preferrably: Payments, as there are many employees balances to finalize],

-- Add a description (eg. Sal-Bal-Jan20) and posting date

-- Set the 'AP' to '2190-Accured Wages Payable, among other details.

-- Enter the amount balance under 'Paid' and check activate the box adjacent to the amount just entered.

The entry could look like this: